What if your best legal defense wasn’t a lawyer—but a lens?

Insurance fraud costs the United States a staggering $308.6 billion annually—that’s nearly the GDP of Finland. To put that in perspective, American families pay an additional $400 to $700 per year in insurance premiums just to cover the cost of fraud. And commercial vehicles? They’re not just victims—they’re prime targets.

Every year, staged accidents and false claims cost fleet operators millions in payouts, court fees, and insurance hikes. It’s not just happening in high-traffic cities or during risky deliveries. It happens in parking lots, back alleys, and on quiet suburban streets—anywhere a commercial vehicle can be targeted as an “easy win.”

Commercial vehicles are favorite targets for staged accidents because criminals know that a company vehicle will be insured or if it is self-insured, accomplice attorneys know most companies will settle out of court once a lawsuit has been filed. One Louisiana scammer alone staged more than 50 accidents on highways at night to avoid eyewitnesses, earning over $150,000 from co-conspirators.

And until recently, fleets had little more than hope and hearsay to protect themselves.

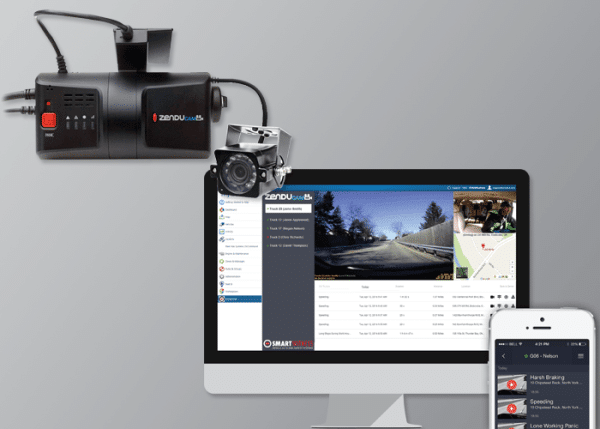

Enter the AI-powered dash cam. These aren’t your average video recorders. They’re intelligent systems trained to detect, interpret, and log events with courtroom-level accuracy. Sudden stops, unsafe lane changes, false rear-end claims—AI cameras capture not just what happened, but why.

Here’s the kicker: fleets using AI-powered video are seeing claim reductions of up to 60%, some slashing insurance premiums by five figures annually. The return on investment is immediate—and the peace of mind? Priceless.

In this article, we’ll break down the real ROI of AI cameras, the evidence that insurers and judges actually trust, and why fleets are now treating these devices as legal armor, not just safety tech.

The Real Cost of False Claims and Fraud

The numbers are staggering. According to the Coalition Against Insurance Fraud, staged auto accidents cost the industry more than $20 billion annually, with commercial vehicles bearing a disproportionate share of fraudulent targeting. The average fraudulent claim settlement ranges from $30,000 to $100,000+, but that’s just the beginning.

Even when fleets successfully defend against false claims, legal costs typically run $15,000 to $40,000 per case. Win or lose, insurance premiums often increase 25-50% after claims—meaning even completely innocent operators pay the price for becoming targets. The financial bleeding doesn’t stop there.

Consider the operational disruption: drivers face stress and potential resignation after false accusations, vehicles get impounded during investigations, and management time gets diverted from running the business to fighting legal battles. Meanwhile, company reputations suffer damage in local markets where word travels fast.

Why are commercial vehicles such attractive targets? Simple economics. Professional fraudsters perceive commercial fleets as having “deep pockets” and comprehensive insurance coverage. Courts and juries often assume professional liability in any commercial versus personal vehicle incident, creating higher settlement potential due to business insurance policies.

The National Insurance Crime Bureau reports that organized fraud rings specifically research and target commercial routes, turning honest business operations into unwitting participants in elaborate insurance schemes. These aren’t random opportunists—they’re sophisticated criminals running profitable enterprises built on exploiting the legal system’s bias against commercial operators.

Why Traditional Evidence Isn’t Working Anymore

Here’s the harsh reality: basic dashcams and traditional documentation methods are failing fleet operators when they need protection most. Standard cameras capture limited angles and context, providing no real-time analysis of suspicious behavior patterns. Poor video quality in challenging lighting conditions means crucial details disappear precisely when you need them most. Missing audio eliminates the possibility of capturing staged conversations or coordinated signals between fraudsters.

Legal vulnerabilities multiply in “he said, she said” scenarios that consistently favor the perceived “victim.” Juries naturally sympathize with individuals versus commercial entities, creating an uphill battle from day one. Without pre-impact footage showing suspicious vehicle positioning or data on vehicle dynamics during incidents, fleets enter courtrooms essentially defenseless.

Meanwhile, fraudsters continue evolving their tactics. The Insurance Research Council found that claim fraud has become increasingly sophisticated, with organized rings using detailed staging techniques, conducting social media research to target specific fleets and routes, and demonstrating deep knowledge of legal systems and insurance claim processes. They coordinate between multiple “witnesses” and understand exactly which evidence gaps to exploit.

The traditional approach of hoping for honest accidents and fair legal proceedings has become a luxury fleets can no longer afford.

What a Smarter Approach Looks Like

Modern AI-powered camera systems represent a complete paradigm shift from passive recording to active legal protection. Here’s what sets them apart:

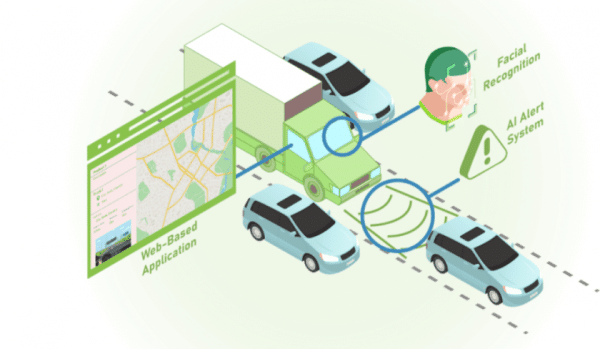

- Multi-Angle Evidence Capture 360-degree coverage eliminates blind spots that fraudsters exploit. Road-facing, driver-facing, and side-view cameras provide comprehensive documentation, while high-definition recording maintains clarity in all lighting conditions. Automatic incident detection triggers extended recording windows that capture crucial pre- and post-impact behavior.

- Behavioral Analysis and Context Advanced AI analyzes pre-impact vehicle positioning and movement patterns, detecting suspicious “brake checking” or sudden lane changes that indicate staging attempts. The technology recognizes unusual pedestrian behavior before claimed “accidents” and identifies multiple vehicles working in coordination—telltale signs of organized fraud operations.

- Forensic-Quality Data Collection GPS coordinates and timestamps synchronize with video evidence, creating legally bulletproof documentation. G-force and vehicle dynamics data during incidents provide objective measurements that can’t be disputed or manipulated. Speed, braking, and steering input documentation offers complete transparency into driver actions, while audio capture preserves conversations and ambient sounds that often reveal fraud.

- Legal-Ready Evidence Packages Perhaps most importantly, these systems automatically generate incident reports with relevant video clips, maintain chain of custody documentation for court admissibility, and present evidence in professional formats designed for legal proceedings. Many providers offer expert witness testimony support and training, turning technology vendors into legal allies.

Consider this real-world scenario: A logistics company driver was accused of rear-ending a luxury sedan at a busy intersection, with the ‘victim’ claiming severe neck injuries worth $75,000. Traditional dashcam footage showed the collision but missed the crucial detail that won the case.

AI analysis revealed the sedan had actually reversed into the truck after monitoring systems showed it had been following the commercial vehicle for three blocks, waiting for the perfect intersection. GPS data confirmed the sedan’s unusual stopping pattern, and multi-angle footage captured the driver’s coordinated hand signals to nearby ‘witnesses.’ The case was dismissed, the driver exonerated, and $75,000 saved—plus immeasurable protection of the driver’s career and mental health.

What’s at Stake—and What’s Possible

Fleet operators continuing to operate without intelligent camera protection face escalating exposure to organized fraud rings, legal defense costs that compound with each incident, driver morale and retention challenges, and insurance premium increases that accumulate year over year. The cost of remaining vulnerable grows exponentially as fraudsters become more sophisticated and legal precedents increasingly favor claimants.

The transformation potential, however, is dramatic. Fleets equipped with AI-powered evidence collection systems report 60-80% reductions in false claim payouts, 90%+ faster case resolution when video evidence is available, and 25-40% decreases in legal defense costs. Perhaps more importantly, they see improved driver confidence and retention as employees feel protected rather than perpetually vulnerable.

Insurance carriers recognize the value too, offering premium reductions for fleets with documented safety and evidence collection improvements. The technology often pays for itself by preventing just one significant false claim.

The operational transformation extends beyond individual incidents. When word spreads that a fleet has comprehensive video evidence capabilities, fraudsters typically move on to easier targets. The mere presence of visible, intelligent camera systems serves as a powerful deterrent that prevents many fraud attempts before they begin.

The Shield Your Fleet Needs

In today’s litigation environment, the question isn’t whether your fleet will face false claims—it’s whether you’ll have the evidence to fight them successfully. Traditional reactive approaches of hoping for fair treatment have given way to proactive evidence collection that presumes innocence and provides proof.

The cost of remaining vulnerable to sophisticated fraud operations far exceeds the investment in intelligent protection systems. Every month without comprehensive evidence collection increases exposure to potentially devastating false claims that can impact operations for years.

Smart fleet operators recognize that AI-powered cameras represent more than safety equipment—they’re legal insurance policies that protect drivers, preserve reputations, and safeguard financial stability. In an environment where organized fraud rings specifically target commercial vehicles, having forensic-quality evidence isn’t just an advantage—it’s essential survival equipment.

The exoneration revolution is here, and the fleets embracing it are turning the tables on fraudsters while protecting their most valuable assets: their drivers and their integrity.

Ready to Shield Your Fleet from Fraudulent Claims?

Want to see how GoFleet helps fleet teams protect against fraudulent claims before they become costly settlements? Our AI-powered camera solutions have helped fleets save millions in false claim payouts while providing ironclad legal protection.

Book a free demo or talk to our legal protection specialists today to learn how comprehensive evidence collection can shield your drivers and your assets from fraud.