Tax Benefits & GPS Fleet Tracking | Save on Taxes!

One of the most well-known quotes about taxes is “in this world, nothing can be said to be certain, except death and taxes.” Even in 1783, people realized that taxes are a constant! Interestingly, tax benefits & GPS fleet tracking go hand-in-hand.

What is the relationship between tax benefits & GPS for fleets? They both relate to fleet management. Part of fleet management includes maximizing tax benefits while reducing tax costs.

Three examples of tax benefits & GPS fleet tracking include:

- S. 179

- Carbon tax

- Business tax benefits

Section 179 (US)

Section 179 is a tax opportunity for GPS tracking programs. Here’s a quick tax review.

Normal Asset Tax Treatment

The IRS allows for “deprecation”. In other words, depreciation accounts for an asset’s wear and tear. As a result, businesses are allowed to deduct a percentage of assets as a tax credit.

What is Section 179?

Section 179 provides an opportunity between tax benefits & GPS fleet tracking. With this section, businesses can elect to deduct $2.5 million of equipment purchase in 2018. Hence, fleets can include out-of-the-box programs like fleet tracking tools in this exemption.

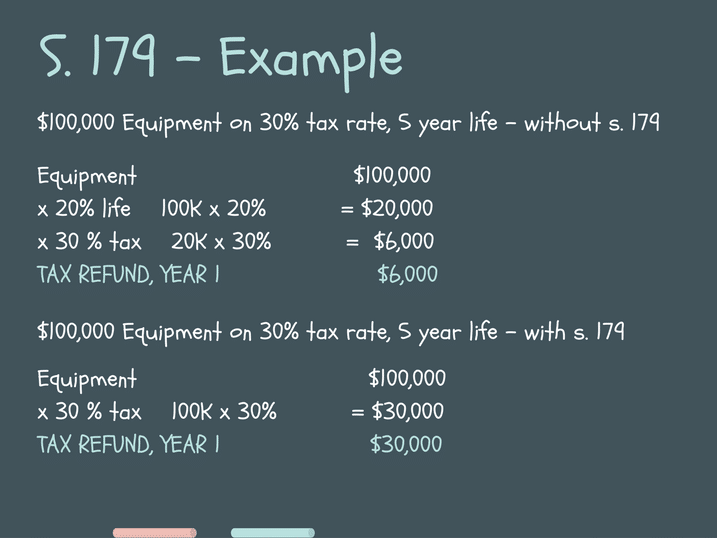

How does the math work?

Think about a $100,000 investment and a 30% tax rate. Normally, only a small portion of $100,000 is allowed to be deducted. However, with Section 179, fleets can get a $30,000 tax credit by deducting the full $100,000 at the 30% rate.

Carbon Taxes (Some states & provinces)

Some provinces and states have carbon taxes.

What is carbon tax?

Carbon tax means that the government collects tax money for each metric ton of greenhouse emission. For example, in Alberta, the government is collecting $10/ metric ton of 2018 emissions. That rate is expected to increase to $50/ metric ton by 2022.

How do fleets cause emission?

Within fleet businesses, operating company vehicles is one of the biggest contributors to gas emissions. Some of the common causes include:

- Poor driving habits. Drivers that drive aggressively or leave their vehicles idling are costing their business! Bad drivers increase total business cost by both wasted fuel and carbon tax.

- Bad vehicle maintenance. To counter the first bullet point, it’s not always the driver’s fault. Sometimes, bad vehicle maintenance leads to bad vehicle fuel performance. Old and aging vehicles produce more emissions than newer vehicles!

- Route management. Finally, some fleets travel inefficient routes. Drivers waste time on the road because their routes are longer than needed.

How can fleets reduce emission?

Many fleets have policies and programs to counter gas emissions. For example, some fleets have a zero-idling policy. Zero-idling means that drivers are not allowed to idle at all. Fleet managers can look at watchdog reports to flag rule breakers.

Beyond no-idling, some other ideas include remapping driver routes, regular vehicle maintenance, and driver training.

Business Tax Benefits (Some states & provinces)

S. 179, discussed earlier in this article, talks about equipment purchase. What about tax benefits after the equipment purchase? Two examples of tax benefits earned during fleet operations include business-use expenses and PTO.

Business-Use Expense

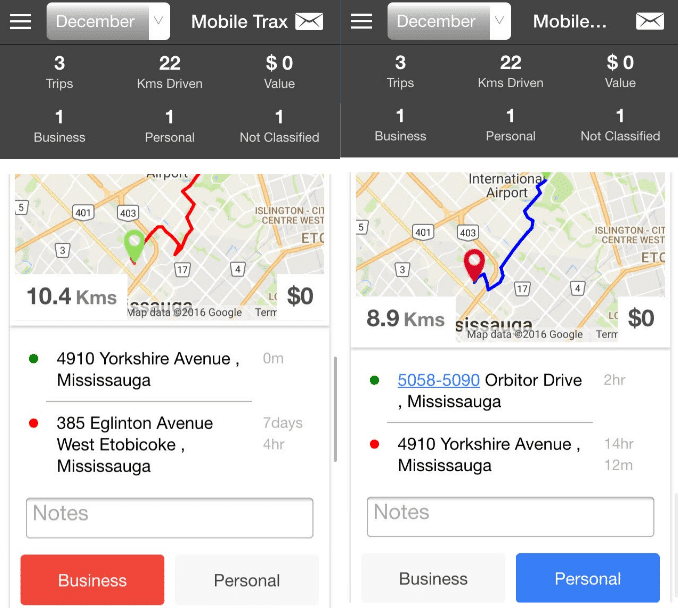

When vehicles are used for business, it is classified as a business expense and is tax deductible. One of the biggest challenges, however, is administering the tax.

“When you apply for tax credits, you have to be very careful to submit the right numbers. We used to double check our files for accuracy,” said a fleet administrator. “Nowadays, most fleets have a tracker to record business use miles. We can trust our tracker to get the right numbers.”

PTO

PTO, or power take off, is another tax benefit. Some states and provinces allow businesses to get a rebate when vehicles use PTO. As a result, PTO equipment such as snow plows, cleaners, and construction vehicles track their PTO hours.